Personal administration

Are you ready?

We can assist you with filing personal income tax (IB-60 and M-form) and requesting government allowances!

On a annual basis we have to do our tax return in the Netherlands, some of us even have to request government allowance. For most people, this is a difficult task! Some people choose to either leave it, or do it themselves, and thus most often missed out on income. A third option is by making use of MC services. With this service, you as a tax-paying citizen can take full advantage of your tax-benefits!

Rules and regulations

When can you apply for the 30% ruling?

- You are in paid employment.

- You have a specific expertise that is not or hardly found on the Dutch labor market.

- You were recruited outside of the Netherlands.

- You are in possession of a valid decision.

Government allowance (benefits)

- Do I have Dutch healthcare insurance?

- Does my child goes to a childcare center?

- Do I have children up to the age of 18?

- Do I live in a rented house in the Netherlands?

Knowledge sharing events and workshops

You can participate in the various events/workshops in relation to the subject matter. In so doing, you can acquire meaningful knowledge. This will increase your understanding of personal administration, which is an asset you need in a capitalistic society, especially if financial freedom is something you value.

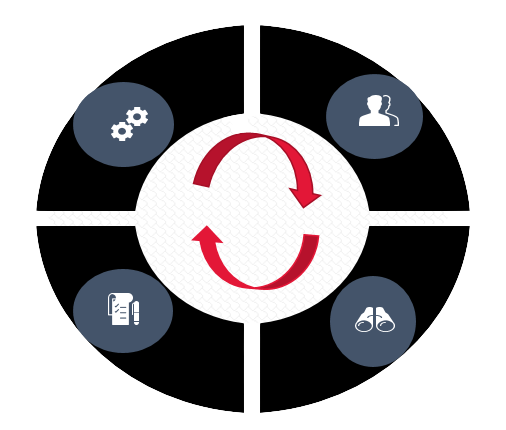

Efficacy

This is Mulbah Consultancy Unique Selling Point (USP). To delivered quality, Process Control is deployed. We see Process Control as the result of proactively analyzing the outcomes of your processes, through cyclically identifying, substantiating and mitigating risks within your administration.

Mitigate risks

When you have a better understanding of what these risks are, you can then build a tool that will enhance Process Control. This is key to keeping your balance in black!

Substantiate risks

It is not only important to know the risks involved, but also what are the factors that trigger these risks? The findings are the building-blocks for an adequate Process Control.

Analyze outcomes

Every entrepreneurs encounter risks in their processes. It is therefore fundamental for one to analyze the outcomes of his or her processes.

Identify risks

By pro-actively analyzing the outcomes, will enable you to identify risks within your processes.

Service packages

Various Application

100 euro per request

Applications

- Childcare

- Healthcare

- Housing

- 30% ruling